Banking. It is an institution almost as old as Money itself and critical to any society that becomes established beyond the communal. Though often regarded with disdain and distrust, which is not unearned, banking is one of the major institutions within developed societies that is frequently used but rarely understood.

This is the next article in the Money Series; for those who haven’t read the previous article, “The People’s Money,” you may want to read that first.

Many terms and definitions are thrown around in banking, such as fractional reserve, brokered deposits, central banking directives and policies, and other human inventions. These concepts and their underlying functions are fascinating and should be better understood by consumers, but that's an article many others have written and will continue to write. If you find yourself among those who need a brush up on terms, I've included a video on just that topic at the bottom of this article.

What is fascinating here isn't necessarily our modern interpretation and application of banking but rather the idea that a bank is fundamentally whatever we say it is. Out of all corporations that derive their value from the marketplace and their ability to attract and keep customers, banking holds a special place in our society. A place so unique that the institution of banking requires a new designation.

Where a regular corporation delivers a product or service to their customers or clients in exchange for compensation for the effort and complexity, a bank is a little different in that their product or service is literal money itself.

Within our societies, there are many fascinating misunderstandings and applications, especially concerning complex systems designed to solve various issues that enable a vast array of influence, power, and equal parts destruction.

One of those very complex systems we have devised is The Corporation, or more formally, the granting of Corporate Title to an entity, causing the 'incorporation' of the thing into a new thing. And yet, within this framework of incorporation, a few distinctions exist that set these types of entities aside from all the rest. I call these entities "Quasi-Corporations" as they aren't quite corporations, but they most certainly are corporate entities.

Quasi-Corporations look and act like regular corporations and yet possess and exhibit an outsized influence on our society, whose failure can have far-reaching devastating impacts upon communities and countries alike.

Table of Contents

Types of Corporations

What is a Bank Exactly?

FDIC

Collapse, Systemic Risks, and Insolvency

-Cash On Hand

-Uninsured Deposits

-Mark-to-Market

Restructuring

Conclusion

Types of Corporations

At least three types of For-Profit corporate entities exist, with distinctions between them. For this article, I’ll ignore the Non-Profits for now. Though they certainly are deserving of focused criticism.

Corporations

Publically Traded or Private, a corporation is essentially an entity that deflects liability from stockholders and owners to facilitate growth and economies at scale in exchange for adherence to a vast array of regulatory requirements relating to Corporate Governance, Ownership, Profit Distribution, and other legislative restraints in exchange for the benefit and privilege of incorporation.

Quasi-Corporations

A Quasi-Corporation is any incorporated entity distinct from a regular corporation within its business or sector related to its fundamental product or service offering. Examples include Banks, Lotteries, Insurance, Pensions, and the like, whose product or service is Money. Though Government and Gambling generally fall under this definition, I exclude them as Government Service is a Public Service, and Gambling’s business model falls more under the category of Entertainment than purely money distribution, deposit, or generation.

Whether we should treat these types of organizations differently from others is answered by the fact that we already do in practically all societies. The regulatory frameworks around Banks and the Insurance Industry are already quite established due to previous crisis responses and continuous lobbying efforts toward deregulation or increasing regulatory hurdles for new or existing entrants.

Public Utility

A public utility is an entity whose business is to provide any service otherwise declared critical to the public’s interest and needs—examples such as waste disposal, electricity, water, or even communication services.

What is a Bank Exactly?

A Depository Bank is functionally just a ledger of accounts. Suppose you utilize online banking or keep your own transactional records. That is fundamentally what the Depository System is, is precisely what you see, minus the Bank's entries, which account for the other side of the "Double-entry Bookkeeping."

Simply put, every time you deposit into a checking or savings account, you generate two transactions through crediting your ledger and adding a liability upon the Bank's ledger of an equal amount to your deposit. This is called "Double-Entry Bookkeeping."

Things get really interesting from banks' special powers, namely the Fractional Generation of Credit.

Imagine you were to apply for a loan from your Bank, which was approved. Upon signing the documents with the Bank, which is your promise to pay and the loan conditions, you are, in effect, creating new money. The amount of the loan you receive is money that has never existed before you signed that document to accept the terms of the loan.

Hypothetically, if we lifted Capital Requirements from Banks, they would be capable of and incentivized to generate infinite sums of money by approving all loans from anyone who applied for any amount requested. Under those circumstances, if any loans were to turn sour, the Bank would discharge the debt off their books and continue loaning to new or existing customers as required. Given this scenario and our understanding of inflation and its devastating impacts, we have strict bank capital controls.

Knowing this now, you can begin to see why smaller Community Banks and Credit Unions are so critical to the communities they serve. Given that their focus is almost entirely on the communities they are a part of. Therefore, their loaning requirements and risk appetites differ from those of National Banks; these service providers are vital to community growth and strength.

As I like to say-

Strong Families Build Strong Communities.

Strong Communities Build Strong Regions.

Strong Regions Build Strong States.

Strong States Build Strong Nations.

Strong Nations Build a Stronger World Order.

Everything starts with you and your communities, with community Banks being integral, and therefore, when our communities and families are under threat, it impacts everything.

FDIC

The Federal Deposit Insurance Corporation came into existence on June 12th, 1933, upon legislative draft and passage by the 73rd Congress of the 1933 Glass-Steagal Act by a Democratic Majority House, Senate, and President F.D. Roosevelt.

Not to be outdone, many nations today have this very same insurance scheme in place by similar names, notables being the CDIC (Canadian Depository Insurance Corporation), United Kingdom’s FSCS (Financial Services Compensation Scheme), and the Australian FCS (Financial Claims Scheme).

The FDIC describes itself as follows:

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by Congress to maintain stability and public confidence in the nation's financial system. To accomplish this mission, the FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions resolvable; and manages receiverships.

-FDIC.gov

Without any concessions, the FDIC is an abject failure within its mandate and purpose. Not only is it almost entirely incompetent in its duty to monitor and supervise financial institutions for Federal intervention before a collapse, but its “management of receivership” is destructive to the soundness of National and State banking stability. A service that not only is your bank paying for in fees, which you are paying indirectly, but also your tax dollars are on the hook in the event of systemic failure. In the most straightforward sense - you are being taxed twice (three times if you include accompanying inflation from bailouts) for a service guarantee that has only failed to deliver on its mandate and legislative purpose.

Welcome to the New World,

The same as the Old World,

With better excuses.

From the outsider's perspective, it appears as if the FDIC was invented primarily because the Nationalization of the Banking System was otherwise politically untenable by that 73rd Congress and all those afterward - a matter which was heavily petitioned for by many in that Congress and has been petitioned by many ever since to this very day.

Let’s run through a few of their stated ‘missions,’ shall we?

“The FDIC Insures Deposits”

The FDIC charges your bank a fee based on total held deposits for this insurance, which you pay for in bank fees or decreased interest rates on savings. The FDIC collects this money into the Deposit Insurance Fund (DIF).

“Examines and Supervises Financial Institutions…”

The FDIC charges another fee to banks for this process quarterly, along with providing otherwise unsolicited advice under threat of declared insolvency, which the FDIC has the power to declare against any Bank they don’t like.

“…For Safety, Soundness, and Consumer Protection;”

An extremely broad mandate with subjective meaning. The FDIC has recently admitted they are understaffed and incapable of performing this duty. The FDIC employs around 5,800 staff with an annual revenue of almost $9 Billion.

For Perspective - FDIC-Insured Institutions amount to 4,703 as of March 2023 (a 44% drop since the year 2000).

That’s 1.2 Staff Members per Institution Supervised.

“Makes Large and Complex Financial Institutions Resolvable”

Translation: In the heat of a panic or bank run, they offer a few recommendations to a distressed financial institution and then watch the carnage until they decide to step in. They do this because, as per the FDIC, they are “understaffed” and otherwise incapable of monitoring the Soundness and Safety of the Financial Institutions that pay them directly to perform that function.

“Manages Receiverships”

This is a fancy way of saying they walk into your bank, audit the books, nationalize the organization, transfer deposits and assets into a ‘bridge’ corporation they created, appoint a new CEO and Board, fire everyone else, and start a fire sale to any National Bank they deem qualified who wishes to scoop up your deposits and loans.

Given the above, one would assume that the logic behind these drastic and irreversible steps is sound. That an arms-length Government institution and regulator wouldn’t just shut down banks, destroy consumer confidence, wipe out debtors and investors, send markets into a panic, destroy hundreds of billions worth of gains, and wind the entire public into a panic through catchy digital printed headlines without logic based in the highest principles of Banking and Financial Management, right?

Right?!

Collapse, Systemic Risks, and Insolvency

While most people, I can only assume, understand what bankruptcy is, the question arises as to what precisely a Bank Bankruptcy is.

Though rarely referred to as bankruptcy when discussing banks, as banks rarely go bankrupt in our modern world, instead we have developed a variety of catchy terms to describe the failure of a bank, which fit just nicely across headlines, namely:

Collapse, Insolvency, Failure and Systemic Risk.

Where collapse and failure are essentially the same thing, the implication is that the Bank itself has done a series of bad things, and the entire institution is belly-up. Therein, the Bank has accumulated too many debts or bad investments, threatening consumers' deposits and presenting a crisis situation to any consumer or business whose cash or loans are held within that institution.

Insolvency is the state of an organization or corporation before or during a bankruptcy. Within this declared state, the organization is seeking to account for and settle any debts that are coming due or already due, find buyers for assets to onboard liquidity (cash), or, in the most dire of circumstances, prepare documents that they intend to file bankruptcy (Chapter 7 or 11).

This leaves us with the newest addition by regulators in terms of 'Bank Bankruptcy' declarations, which is Systemic Risk, a newly established power granted to the FDIC through the FDIC Improvement Act of 1991.

To understand Systemic Risk, we must first understand the following, which I call:

The 3 Metrics of Modern Collapse

Cash on Hand

Uninsured Deposits

Mark-to-Market

Cash On Hand (COH)

“The Federal Reserve Act lets us print all we’ll need. And it won’t frighten the people.

It won’t look like stage money. It’ll be money that looks like real money”

-Federal Reserve Bank of Boston

Closed for the Holiday: The Bank Holiday of 1933

COH is, without a doubt, an antiquated metric for measuring banks, systemic risk across the banking system, and the general health of any institution. Our world is digital now. 98% of all money within the system is digital money. Therefore, the idea that a Bank would carry a large cash balance within its vaults that goes above and beyond daily and weekly transaction expectations is equally old-fashioned. Meanwhile, the requirement of immediate liquid assets (such as short-term treasuries) under a Federal Reserve System and functioning Treasury is either laughable or criminal. In this modern era, we find ourselves in a weird position where we treat Banks legislatively as if they have 'The People's Money' while denying them remediation provided through the proliferation of 'The Government's Currency' and the Federal Reserve System.

In the case of SVB, they had an estimated 5% of their total deposits in cash and liquid assets (approximately $9 Billion), with the average COH in the banking sector estimated at only 13%. However, many institutions don't carry that high of an amount.

Referring back to the previous article in this series, remember the lesson:

No one gets rich by holding the People’s Money,

&

No one stays rich by holding the Government’s Currency.

Therefore, why would a bank with full knowledge of this fact ever hold a sizeable quantity of the Government’s Currency if they don’t need it for daily or weekly transactions? Every dollar sitting in any vault is losing its value every second, every day, across every year, ad infinitum.

From what I gather, the official reasoning for this metric relates to historical bank failures almost a century ago. Thus, the logic here is that if Banks hold enough cash deposits within vaults during an unexpected Bank Run, they could meet most or all of that immediate demand from their customers seeking cash withdrawals.

The problem here, as was famously iterated in the classic “It’s a Wonderful Life” (1946) bank scene, is that banks don’t carry most deposits in vaults. The idea of such a thing is as asinine today as it was in the early 1900’s and before. Customers demand returns on their money deposited within institutions to maintain purchasing power; otherwise, they would stash the cash in a home safe.

Uninsured Deposits

In George Harrison’s view, the Federal Reserve Banks would

“become in effect guarantors of the deposits of reopened banks”

-Allan Meltzer

A History of the Federal Reserve. Volume 1

One of the other oft-mentioned reasons for claiming 'Systemic Risk' by the FDIC, Treasury, and California State Regulators against SVB and others afterward was this little metric called 'Uninsured Deposits.' The press, which endlessly repeated this little phrase as causation and logic for the Nationalization of SVB and other Banks, never bothered to explain the origin of this phrase.

As was repeatedly reported, SVB's deposits were 85% uninsured. The meaning behind this is simple: SVB was an FDIC-insured institution, which was granted only basic coverage to the amount of $250,000 per account.

Regardless, it has been repeated that most Financial Institutions have around 55% Uninsured deposits, and this was one of the reasons presented to the public and press to claim Systemic Risk.

Mark-to-Market (MTM)

Question: How do you destroy a Bank whose books are sound, customers are loyal, deposit requirements are secured, and investments are adequately diversified against risk?

Answer: Change the rules of Accountancy.

Perhaps not surprising to you, this particular topic is highly contentious and complex. MTM has been debated worldwide in Parliaments, Firms, and Congress for almost a century across various changing definitions, accountancy standards, international codes, and other nefarious attempts at proliferation of its underlying logic, or lack thereof.

The difficulty here, for me as the writer attempting to explain this to you, isn’t so much the complexity of the word or its shifting applications over time. It isn’t from the historical precedence and the removal of that precedence by actors who are either complicit in its underlying function or perhaps too damn ignorant of its impact. Instead, the complexity is almost built into the thing, which is why MTM has been so successful in what can only be described as the purposeful and manufactured destruction of the very thing it purports to support, which is sound Accountancy and relaying of critical information for the purposes of Investor Confidence, Financial Assessment, and Overal Market Signals.

To start: Accountants are like Physicists, only with half the intelligence and none of the adaptability.

It’s important to remember that good accounting principles were developed long before the Accountant. We merely invented the Accountant because no one wanted to learn all the intricacies of the rules.

If you want to start a business, ask an investor or stakeholder about the company; don’t ask an accountant.

If you want to manufacture a chocolate bar for domestic consumption, focusing on good ingredients and solid marketing, you don’t ask an accountant.

Whereas, if you want to obliterate the Banking Sector completely, you tell an accountant that a particular rule change better aligns with increasing investor standards, unification of developing international codes, and long-held good accountancy practices and procedures - then watch as that individual plants his flag on the hill you built him as he pledges his life to defend it.

{As an aside, I find it extremely disturbing that one of our last apolitical institutions, Accountancy, is being cloaked in politics and used unabashedly for political gains. It is a true loss for us all, especially once the public discovers that “numbers” have become political.}

Basic Definitions:

-SEC - US Securities and Exchange Commission, an arms-length government entity seeking to make everyone as miserable and morally bankrupt as they are.

-Securities - A tradable Financial Asset, also commonly called a Financial Instrument

-Brokered Deposits - Large sums of money can be placed with Brokers who seek higher interest rates among FDIC-insured banks who require elevated liquidity to meet Capital Requirements. The opposite of this is called ‘Core Deposits’, in which individuals open an account and deposit funds directly within a Financial Institution.

-IFRS - International Financial Reporting Standards, built and maintained by the International Accounting Standards Board (IASB), is currently being implemented across 133 Jurisdictions, including the EU, Australia, and Canada.

-GAAP - Generally Accepted Accounting Principles, which is specific to the USA, and as of around 2008, is being co-opted into a new codified standard in order to perpetuate concepts such as MTM by the FASB.

-FASB - Financial Accounting Standards Board, specific to the USA, is an organization of half-wits attempting to re-write GAAP into a new Codified System for International Alignment so that the entire global system is destroyed simultaneously. (Accountants hate loose ends)-SFAS - Statement of Financial Accounting Standards, was the precursor accounting unification standards in attempts at modifying the GAAP. This Standard was abandoned in 2009 and replaced with the “FASB Accounting Standards Codification” due to political scrutiny

-MTM - Mark-To-Market, also known as Fair Market Value, Fair Value, Value Accounting, Fair Value Accounting, M2M, etc.

-HCP - Historical Cost Principle, one of the fundamental principles of GAAP accounting and one of the reasons for US Commercial Success and Strength among financial institutions across almost two centuries.

-Impairment - The accounting markdown of an asset within financial statements expressed as a loss after the permanence of the loss is determined.

Quick History: MTM policies are not new, though the detailed history of these fair market reporting policies isn’t entirely clear or has been effectively scrubbed from most memory. What I’ve gathered:

Between 1905 and 1930, the original implementation of MTM reporting requirements among financial institutions was implemented, which was more than likely heavily influenced by the newly established Federal Reserve in 1913.

Fast forward to around 1940 when these policies were determined to be highly toxic to the health and functioning of the wider economy and individual Financial Institutions.

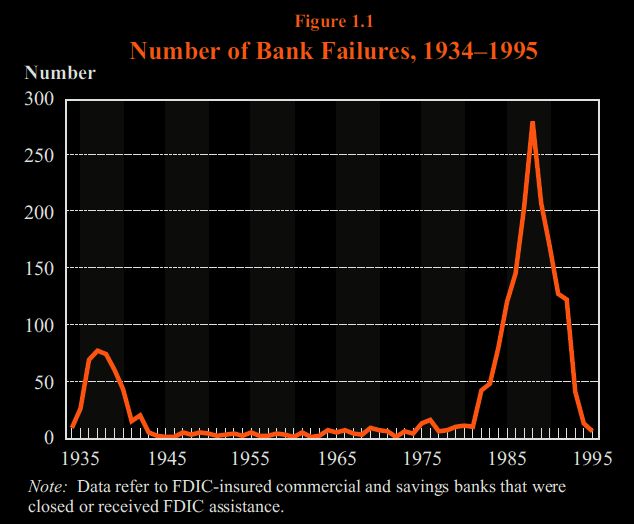

Fast Forward again to 1972 and the Founding of the FASB, which sought, among many ideas, to rewrite the US GAAP. MTM policies later gained prominence between 1980 and 1981. These policies, among others, later influenced the 1981-1994 economic and financial meltdown, culminating in the infamous 1987 Crash and the Savings and Loan Crisis, which saw over a thousand banks destroyed in a short period.

Background: Between 2008 and 2011, approximately 400 banks in the US failed. The Government was sent into a panic over disastrous news coverage and the threat of the entire system melting. Fire and brimstone would rain from the heavens, they told us, unless this Bill was passed titled “The Emergency Economic Stabilization Act of 2008,” which later became known to the public as “TARP” (Troubled Asset Relief Program).

For those of you who forget or are too young to remember, this clip from the Movie “Too Big To Fail” (2011) will hopefully help stress the significance.

{Interesting aside - Under a Federal Reserve System, at any point, the Federal Board could have extended an infinite line of credit to any member bank within that system without costing taxpayers a single penny. Each bank at the table within that video clip was a Federal Reserve Member Bank. The entire 700 Billion Dollar Bail-out ($4.6+ Trillion Total) was a training exercise to teach the public about Bail-Outs before the inevitable (and upcoming) Bail-Ins to which every country within the G7 has a legislative framework already enacted and waiting.}

The Emergency Economic Act, which had a lot of provisions attached, as most Government bills these days do, had what is, in my opinion, one of the most significant additions to any Government Bill in my lifetime. Specifically, I’m referring to Section 133, as written and passed:

SEC. 133. <<NOTE: 12 USC 5238.>> STUDY ON MARK-TO-MARKET

ACCOUNTING.

(a) Study.--The Securities and Exchange Commission, in consultation

with the Board and the Secretary, shall conduct a study on mark-to-

market accounting standards as provided in Statement Number 157 of the

Financial Accounting Standards Board, as such standards are applicable

to financial institutions, including depository institutions. Such a

study shall consider at a minimum--

(1) the effects of such accounting standards on a financial

institution's balance sheet;

(2) the impacts of such accounting on bank failures in 2008;

(3) the impact of such standards on the quality of financial

information available to investors;

(4) the process used by the Financial Accounting Standards

Board in developing accounting standards;

(5) the advisability and feasibility of modifications to

such standards; and

(6) alternative accounting standards to those provided in

such Statement Number 157.

(b) Report.--The Securities and Exchange Commission shall submit to

Congress a report of such study before the end of the 90-day period

beginning on the date of the enactment of this Act containing the

findings and determinations of the Commission, including such

administrative and legislative recommendations as the Commission

determines appropriate.To the Congress member(s) or Senator(s) who had this amendment inserted, I shake your hand. You became a true statesman for at least one moment in your political career.

What followed from the SEC was a 259-page document titled:

I want to draw your attention to two immediate things you might have already noticed about this document.

This document was prepared by the Chief Accountant’s office of the SEC, not the SEC Commission itself.

This document was prepared by the Staff of that Department and in no way represents the views of the Commission itself.

Unfortunately, whether because the individual who drafted the amendment wasn’t aware, or it was drawn with a nefarious, misdirected purpose, this amendment specifically called into question the SFAS 157 and 159 Accountancy Standards. The failure is that the SEC report was also completed within that scope and view.

As the SEC report later iterates, the SFAS, though mentioning standards under the MTM, is not the smoking gun that the amendment supposes it is.

As stated by the SEC Staff within that document:

“As discussed further in this study, SFAS No. 157 does not itself require mark-to-market or fair value accounting. Rather, other accounting standards in various ways require what is more broadly known as “fair value” accounting, of which mark-to-market accounting is a subset.”

-SEC Report, Excecutive Summary, Pg 11

That executive summary goes further to address the critics who inserted amendment 133 and thus forced the drafting of the report:

“In the months preceding passage of the Act (Emergency Stabilization Act 2008), some asserted that fair value accounting, along with the accompanying guidance on measuring fair value under SFAS No. 157, contributed to instability in our financial markets. According to these critics, fair value accounting did so by requiring what some believed were potentially inappropriate write-downs in the value of investments held by financial institutions…”

The paragraph here goes on to discuss what is best viewed as a deflection. The report essentially makes the case that those in Congress who objected to MTM Accounting Policies related to Financial Statements of Financial Institutions were explicitly concerned with “… inactive, illiquid, or irrational markets that resulted in values that did not reflect the underlying economics of the securities.”

This is a blatant misdirection.

The concern with MTM directly related to financial institutions is not illiquid or inactive. Derivatives products are already, and have been since their invention a few decades ago, mark-to-market products for Financial Statements based on best assumption guidelines. A derivative product is a financial container containing an underlying value proposition imagined along a financial algorithm and packaged as an exotic product, and thus tricky to immediately value - this is not the concern.

Furthermore, the concern is also not related to ‘irrational market’ conditions, in which securities market value may rapidly fall even below the underlying value of the thing that has been securitized.

Example: Your home mortgage is packaged as a security product along with hundreds of other mortgages, where the valuation of that security product falls below the underlying value of the homes against which the mortgages have a lien.

The Report continues:

“These voices pointed out the correlation between U.S. GAAP reporting and the regulatory capital requirements of financial institutions…”

If those ‘voices’ did that, they misunderstood or misspoke about the actual concerns. Before 1981, the US GAAP reporting standards for Financial Institutions were more than acceptable for investors and transparency of our Banking Sector.

“…highlighting that this correlation could lead to the failure of long-standing financial institutions if sufficient additional capital is unavailable to offset investment write-downs.”

Which is a nearly impossible regulatory and mathematical standard to set against these institutions given the nature of their regulations, scope of business, new requirements of reporting under mark-to-market, and function within the economy.

They conclude the opinion of these ‘voices’ by saying:

“Further, they believed the need to raise additional capital, the effect of failures, and the reporting of large write-downs would have broader negative impact on markets and prices, leading to further write-downs and financial instability.”

This is most obvious to anyone who understands markets, banking regulations, and the cause and nature of Financial Institutional failure. It is not a belief. We’ve spent the last century proving this point to the detriment and destruction of hundreds of millions of innocent families across the entire globe.

Clarification:

-Imagine a bank called “Bank A”

-Bank A is well-capitalized, publically traded, and sound.

-A market downturn causes some assets of Bank A to depreciate, which is normal.

-Bank A writes down these losses to claim on their taxes and informs their investors in compliance with MTM procedures.

-This write-down signals to the market that Bank A has toxic assets.

-Total write-down of toxic assets is less than 6% of total capital and assets.

-Total write-down is well within standard losses.

-5% of Depositors pull their deposits from Bank A due to Toxic Assets.

-11% loss causes regulatory trigger forcing Bank A to amass more capital to stay within banking regulations.

-Investors refuse capital injection due to assumed Toxic Assets.

-Other Financial Institutions refuse to associate with Bank A due to assumed Toxic Assets.

-Central Bank Investigates Bank A due to Capital Requirements.

-FDIC Begins investigation of Bank A due to Capital Requirements.

-FDIC Denies Bank A a waiver for Brokered Deposits due to Capital Requirements.

-Bank A sells liquid assets at a loss due to a temporary market downturn to meet Capital Requirements.

-Bank A seeks to dilute shares to raise Capital to meet Capital Requirements.

-Share Price is decimated due to assumed Toxic Assets and share price dillution and fleeing Depositors.

-Bank A now must raise more capital to replace the loss of Depositor Funds and Realized/Unrealized Losses of Assets to comply with Capital Requirements.

-FDIC and Federal Reserve arrive onsite of Bank A to investigate their books.

-3 Hours Later, the State Banking Regulatory Agency pulls Bank A’s license.

-State Agency delivers to FDIC Bank A’s assets, deposits, and business.

-Bank A has failed.

-Share Price drops to zero.

Do you see?

The report then goes on to address ‘investor’ voices:

“Just as vocal were other market participants, particularly investors, who stated that fair value accounting serves to enhance the transparency of financial information provided to the public.”

That is not the primary concern from the macro-perspective. All of that information is already publically available and accessed and calculated by those investors.

“These participants indicated that fair value information is vital in times of stress, and a suspension of this information would weaken investor confidence and result in further instability in the markets.”

This particular reasoning is repeated throughout most of the documents I reviewed. The irony is that all this information is publicly available, and those 'investors' know that information. Also, it's incorrect. Our standard operating procedures as it relates to Markets and Exchanges is not to inflate fears and panic by highlighting unrealized losses within an institution that is susceptible to panic selling and withdrawal of deposits, which itself causes Capital Requirement triggers and insolvency after a single-digit percentage unrealized loss during periods of heightened tensions and irrational behavior.

The crux of Investor Confidence is based on the idea of the Value of Money, the fortitude of Holding Institutions and Marketplaces, and the regulations and regulators that theoretically strengthen these systems. Among the most fundamental strengths related to Investor Confidence comes from the above and from calculating the publically available data and its underlying assumptions and core logic. MTM policies inappropriately applied to financial institutions undermine and destroy the very confidence that the SEC is claiming to uphold as a reason for MTM.

Put more simply: Just because your child wants candy for dinner doesn't mean you let them have candy. Equally, just because investors would support legislation requiring every Board of Directors meeting within any company to be publically available and live-streamed doesn't mean we should listen to those voices.

The document created by the SEC Staff then continues, seemingly without end, with a heavy reliance on the idea of Investor Confidence and the stated goals of FASB participants in expanding the fair value measurement, which, by the way, is far beyond their scope of expertise or competency.

“This Statement (SFAS No. 159) is expected to expand the use of fair value measurement, which is consistent with the Board’s (FASB) long-term measurement objectives

for accounting for financial instruments.”

-SEC Report, Fair Value Impacts on Accounting, Pg 39

The very idea that we would ask the FASB for their opinion on public reporting of Financial Disclosures, most especially as it relates to Financial Institutions, is entirely beyond my imagination outside of the possibility of certain participants seeking nefarious ends to competing interests, nations, organizations, populations, or otherwise.

That is to say, if you wanted to purposefully crush another developed economy and cause its internal implosion without the use of military armaments or political subversion - this is precisely the type of methodology you would pursue under the guise of ‘Modernization’ and ‘Transparency’ while directly utilizing our developed understanding of crowd behavior within Behavioral Psychology as it relates to Market Signals.

Restructuring

In the case of restructuring, there are many options. The only real question is whether the Public likes our current system or some semblance of it. In this spirit, I offer you two immediate options to rectify our current predicament.

Option 1 - The Minimalist Option

The character of this option is effectively embracing the Federal Reserve System as it is and is designed. Hereby, we abolish the FDIC, as it's no longer required for deposit insurance or receivership, and mandate the FED through legislation insures and backstops every US Dollar deposit in any account, across most asset classes, within any Depository Institution against failure. If a Bank goes belly-up, it would be handled as any corporation is dealt with and forced into the Bankruptcy Courts through Chapter 7 or 11 filings.

-If we have concerns about Capital Disbursement across institutions, an FDIC-styled cap on maximum insurable deposits, such as the current $250,000 FDIC limit, could be applied.

-Without the FDIC Insurance Premiums (which dramatically increase after each bank failure until the FDIC DI Fund is balanced), each Bank would be significantly more profitable and under far less systemic burden and stress during or following market downturns.

-This option doesn't fully address the FASB/IFRS issues around Financial Institution mark-to-market reporting, but considering every dollar is insured, it isn't the Public's problem at that point. When a situation arises that a Bank is beginning to fail, the Public could run to that Institution and open new accounts for no other reason than to receive a check from the Federal Reserve once the dust settles.

-This option should, theoretically, buy the Public another 35 years or so before the next subversive issue rears its head if we use history as our guide. Though we would effectively kick that can down the road, this option would be far easier to pass legislatively and significantly more straightforward to educate the Public on (while also utilizing the Public's inherent ignorance of this topic and the nuances involved.)

Option 2 - The Quasi-Approach

This approach, I would yield to you, is a little more unique. By creating a new Corporate Distinction titled “Quasi-Corporations,” we can apply this to all existing and new depository banks. This distinction provides isolation from the subversions that otherwise impact regular corporations, such as the previously discussed FASB/IFRS.

-Quasi-Banks would provide their usual Financial Statement Reporting under the previous 1971 US GAAP guidelines and format.

-Quasi-Banks would not be required to pay insurance premiums to the FDIC or Federal Reserve as all deposits are 100% covered against loss caused by failure, mismanagement, or disorderly conduct through the Legislative Framework. (Ledger Splitting)

-Quasi-Banks would be excluded from Federal Reserve Member Bank or Primary Dealer Status in accordance with Free Market Principles and the assurance of equal access and fair competition.

-Quasi-Bank operating license and Incorporation Title would be immutable as long as there are enough depositors to maintain operations or until the Bank itself chooses to dissolve or under express circumstances where the Bank or its Officers are displaying disorder. (Future-proofing Attack Vector Protection)

-Congress shall assume the power to institute No Capital Requirements during a crisis (Not the Federal Reserve) and thereby set a minimum by which Congress needs to authorize any further lowering up to and including no requirement.

-In the event of catastrophic failure, mismanagement, or disorderly conduct as determined by Congressional Regulations - State Banking Regulators will have the power to isolate Deposits from the Quasi-Bank’s balance sheet and instruct for an immediate and total payout of all balances to account holders, irrespective of debts or obligations, of the Quasi-Bank, its associates, claimants, or otherwise.

-A variety of existing Legislative Frameworks regarding Depository Institutions would need to be amended, including but not limited to:

Capital Requirements

In the event a Quasi-Bank falls below Legislative Capital Requirements, that bank is ordered to cease new lending until they address the balance. The bank will not be placed into receivership. The bank will not be dissolved. The bank will continue as normal until their extended credit is repaid or offloaded or they attract new deposits above capital requirements.

Discharge

Write-downs, Impairments, Depreciations, Defaults, etc., will be quickly discharged from the Quasi-Bank’s books and financial statements to ensure the availability of credit potential and maintenance of ‘Investor Confidence’ within the marketplace.

Conclusion

If we lived in an idealized world, the solution for most of our issues would revolve around educating the public. Unfortunately, our world isn't that simple. How easily we have been bought off and won over by emotional arguments, by regulators claiming the highest principles as their mandate, or by Governments claiming the highest authority and best ideas as their justification. Our enemies are very clever. They have within their institutional power the capability of bringing hellfire upon our societies as we have never seen in any memory while rousing from slumber that most violent and destructive mob that waits for emotional triggers to enact their building fury.

Any adequate solution we imagine must be better proofed against future attempts at subversion. As our enemy does not breathe, it does not sleep, and it will lay in waiting for decades or centuries if it must, all for the achievement of its goals and ends.

Critically, we must decide for ourselves if we are to continue with 'The Government's Currency' and, therefore, enact the proper legislative framework to support and sustain that position, or we must revert to 'The People's Money' and rebuild the legislative framework of that classification. Our ad hoc style of enacting and acting out the worst parts of both systems is neither sustainable nor concurrent towards long-term growth in any nation where these systems are framed.

I firmly believe that the next 7-15 years will be quite historical, if not outright biblical, as it relates in the financial sense. The exact timeframe is only as unclear as our politician's willingness to pick a legislative direction, even if that direction is inaction itself - which is doubtful but debatable.

A debt was created long before we or our parents were born. A debt that has no precise number, no accountancy, and most certainly no accountability. That debt was created with intention and will be paid one way or another.

A debt imparted upon us by the long departed.

It is in the Government's interests to keep that debt rolling ever forward for as long as it is mathematically possible and socially tenable. That interest has been the interest of all Governments for over a Century. That interest is itself a multiplier of the debt.

Every day, we roll forward that debt, and it increases in magnitude until the day it eventually comes due.

I want to be clear here - Though I understand you and many others may not fully grasp the consequences of these actions among others, this right here, right now, is the pivotal moment when everything around us has shifted.

This period, right now, in our modern era of modern ideas, is what historians will look back at while researching the why and when.

We are indeed witnessing a potentially cataclysmic future brought to us by pure incompetence, the pursuit of headline fame by regulators, and a panicked sense of morality, all under the instruction and guidance of an enemy we don't recognize.

One day, we can work together to make Banking and Accountancy boring again,

Until then, buckle your seatbelt,

and,

May God, if he exists, have mercy on us all.

As always,

Farewell, and Good Luck.

-Dark Philosopher

Article Updates

17/01/24 - Uploaded Final Video with some modifications.

Links

73rd United States Congress

https://en.wikipedia.org/wiki/73rd_United_States_Congress

FDIC Information

https://www.fdic.gov/resources/regulations/

https://www.fdic.gov/resources/deposit-insurance/deposit-insurance-fund/

FDIC Employees and Estimated Revenue

https://www.owler.com/company/fdic

SEC “Report and Recommendations Pursuant to Section 133 of the Emergency Economic Stabilization Act of 2008: Study on Mark-To-Market Accounting”

https://www.sec.gov/files/marktomarket123008.pdf

Emergency Economic Stabilization Act of 2008 (T.A.R.P.)

https://www.congress.gov/110/plaws/publ343/PLAW-110publ343.htm

1933 Banking Holiday

https://www.federalreservehistory.org/essays/bank-holiday-of-1933

Recent Failure Case Studies:

Signature Bank

https://www.fdic.gov/news/press-releases/2023/pr23018.html

SVB

https://financialpost.com/pmn/business-pmn/u-s-fdic-shifts-svb-deposits-to-new-bridge-bank-names-ceo

First Republic Bank

https://apnews.com/article/first-republic-bank-silicon-valley-fdic-5ab48702b7136d42f73ac13e0a20955d